Role of Form 1040-ES in the Tax System

IRS Form 1040-ES is an important document for taxpayers who must pay estimated taxes on income not subject to withholding, such as earnings from self-employment, interest, dividends, alimony, or rental income. Estimated tax-related payments are made quarterly, and the federal 1040-ES tax form provides the necessary vouchers and guidelines to help individuals calculate and submit their payments correctly to the IRS for the 2023 fiscal year.

Navigating the complexities of federal tax forms can be daunting, but the value of our website, 1040es-taxform.com, lies in its rich repository of materials that demystify this process. With comprehensive checklists, well-detailed examples, and access to 1040-ES form instructions, the resources available on our site empower taxpayers to manage their estimated tax payments effectively. These tools are designed to simplify completing the printable 1040-ES tax form for 2023, ensuring that users can fulfill their fiscal obligations with confidence and accuracy.

Table of Contents

IRS Form 1040-ES & Obligated Taxpayers

Individuals who have income that isn't subject to withholding, including earnings from self-employment, dividends, interest, alimony, or rental income, typically need to file IRS Form 1040-ES. This form is utilized to calculate and pay estimated taxes on a quarterly basis.

Consider a Case

Imagine Sarah, a freelance graphic designer who has recently transitioned from a traditional employment role to managing her own business. She now needs the 1040-ES for business income that she earns from various clients throughout the year. Since Sarah's income isn’t taxed by an employer, she prints the 1040-ES form for 2023 to determine and remit her estimated tax payments to the IRS to avoid underpayment penalties.

Imagine Sarah, a freelance graphic designer who has recently transitioned from a traditional employment role to managing her own business. She now needs the 1040-ES for business income that she earns from various clients throughout the year. Since Sarah's income isn’t taxed by an employer, she prints the 1040-ES form for 2023 to determine and remit her estimated tax payments to the IRS to avoid underpayment penalties.

Every quarter, Sarah carefully calculates her expected income and expenses to accurately fill out IRS Form 1040-ES on time. This ensures that she stays compliant with the tax code by paying her fair share of taxes based on her business profits while also keeping her finances in check.

Filling Out IRS 1040-ES Tax Form Error-Free

- First, download the printable 1040-ES estimated tax form available on our site. Ensure you have the correct year’s template.

- Gather all necessary documents, such as last year’s return and current year's income, deductions, and credit estimates.

- Use the 1040-ES worksheet, which simplifies the calculation process by breaking down the steps to estimate your taxes accurately.

- Remember to factor in any expected changes in income or deductions for the current year while using this worksheet.

- Understand what qualifies as adjusted gross income and calculate it correctly. AGI is a key figure in determining your fiscal liability.

- If you're self-employed, be sure to deduct eligible business expenses. This reduces your net income and, consequently, your fiscal liability.

- After completing the calculations, fill out the blank Form 1040-ES with the estimated tax amounts.

- Be aware of other credits that you may be eligible for, such as the Child Tax Credit, Education Credits, or the Earned Income Tax Credit.

- Don't forget to include income from all sources, including freelance work, side gigs, and investments.

- Review the form for accuracy, as errors can lead to penalties or interest charges.

- Follow the submission instructions from our website to file your form either online or via mail. Keep a copy for your records.

- If your financial situation is complex, consider seeking advice from an advisor. They can help you with your situation.

Due Date for Form 1040-ES in 2024

Filing your IRS Form 1040-ES, estimated tax, is important to managing your payments throughout the year. The IRS sets specific due dates for those required to make quarterly payments to maintain compliance. Typically, the due date for the first payment is April 15th of the current financial year. This aligns with Tax Day, the deadline for individuals to file their previous year's federal returns, ensuring taxpayers are simultaneously settling last year's taxes and planning for the current year's potential liability.

Regarding IRS tax form 1040-ES for 2023, the deadline is shifted to the next business day if this date falls on a weekend or holiday. It's a strategic timing that allows taxpayers to assess their income comprehensively and make accurate estimated payments.

Federal Form 1040-ES: Vital Notes

The IRS provides options for those unable to meet the April deadline. It's possible to get a fillable 1040-ES to file online, which streamlines the process, offering a faster and more convenient submission. However, it's essential to note that while technology facilitates timely filings, the IRS does not typically grant extensions for estimated tax payments. Failure to pay by the due date can result in penalties, so it's wise to prioritize meeting these deadlines or adjusting withholdings to mitigate any shortfall in estimated tax payments.

Q&A: IRS 1040-ES Estimated Tax Form

- Who needs to file a federal tax form 1040-ES for 2023?Individuals, including sole proprietors, partners, and S corporation shareholders, generally must make estimated tax payments if they anticipate owing $1,000 or more in taxes when their return is filed. Utilizing the printable 1040-ES template helps estimate the amount due to ensure you're compliant with the IRS requirements for the upcoming year.

- How do I determine the amount of taxes to report on the 2023 tax form 1040-ES?To accurately figure out the tax amount on the 1040-ES, you should estimate your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year 2023. After calculating these values, the form provides instructions to help you determine the amount of your estimated tax payments.

- Where can I find a printable tax form 1040-ES for my estimated payments?The form is readily available on our website for download. It's designed to be printed so you can fill it out at your convenience, ensuring you have a physical copy for your records and for mailing to the IRS if not filing electronically.

- Is there a sample of the 1040-ES form available to guide me through the process?Indeed, on our website, there is a sample that can serve as a reference as you fill out your own document. It shows the necessary details and provides a clear picture of how to report your estimated taxes accurately.

- When are the due dates for submitting estimated payments using the printable IRS tax form 1040-ES?For the year 2023, estimated tax payments are typically due on April 15, June 15, September 15 of 2023, and January 15 of 2024. It's vital to adhere to these deadlines to avoid any penalties for late payments, and the form includes specific instructions on where to send your payments.

More About the 1040-ES Tax Form for 2023

-

![image]() IRS 1040-ES Form Instructions Managing your taxes involves understanding various forms and regulations, which can sometimes be overwhelming. One essential document that certain taxpayers need to be familiar with is IRS Form 1040-ES. Whether you're self-employed, an investor, or someone with income that doesn't have taxes routine... Fill Now

IRS 1040-ES Form Instructions Managing your taxes involves understanding various forms and regulations, which can sometimes be overwhelming. One essential document that certain taxpayers need to be familiar with is IRS Form 1040-ES. Whether you're self-employed, an investor, or someone with income that doesn't have taxes routine... Fill Now -

![image]() 1040-ES Printable Tax Form Form 1040-ES, known as the "Estimated Tax for Individuals," is a document used by taxpayers in the United States to pay estimated taxes on income that is not subject to withholding tax. This includes earnings such as self-employment income, interest, dividends, alimony, and rental income. The form i... Fill Now

1040-ES Printable Tax Form Form 1040-ES, known as the "Estimated Tax for Individuals," is a document used by taxpayers in the United States to pay estimated taxes on income that is not subject to withholding tax. This includes earnings such as self-employment income, interest, dividends, alimony, and rental income. The form i... Fill Now -

![image]() Federal 1040-ES Tax Form Form 1040-ES is a crucial tax document used by the IRS to manage estimated tax payments. Estimated tax is the method used to pay taxes on income that isn't subject to withholding. This generally includes income from self-employment, interest, dividends, alimony, rent, gains from the sale of assets,... Fill Now

Federal 1040-ES Tax Form Form 1040-ES is a crucial tax document used by the IRS to manage estimated tax payments. Estimated tax is the method used to pay taxes on income that isn't subject to withholding. This generally includes income from self-employment, interest, dividends, alimony, rent, gains from the sale of assets,... Fill Now -

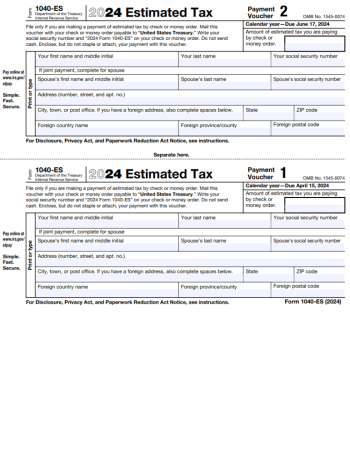

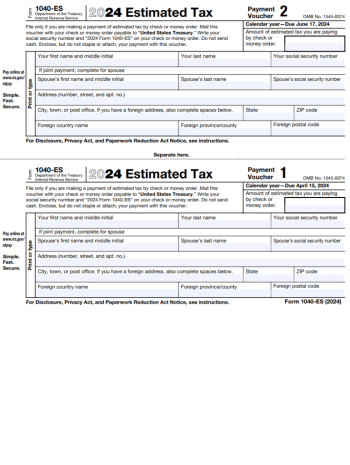

![image]() 2024 Form 1040-ES When it comes to settling up with Uncle Sam, Form 1040-ES can be an essential tool for many taxpayers. Traditionally, this form is used by individuals to pay estimated taxes on income that isn't subject to withholding, like earnings from self-employment, interest, dividends, and rental income. Howev... Fill Now

2024 Form 1040-ES When it comes to settling up with Uncle Sam, Form 1040-ES can be an essential tool for many taxpayers. Traditionally, this form is used by individuals to pay estimated taxes on income that isn't subject to withholding, like earnings from self-employment, interest, dividends, and rental income. Howev... Fill Now