All About Form 1040-ES (Rev. 2024)

When it comes to settling up with Uncle Sam, Form 1040-ES can be an essential tool for many taxpayers. Traditionally, this form is used by individuals to pay estimated taxes on income that isn't subject to withholding, like earnings from self-employment, interest, dividends, and rental income. However, there are some less typical situations that might require a taxpayer to get acquainted with the 2024 IRS Form 1040-ES. Let's delve into some examples and how you might navigate these scenarios.

Atypical Scenarios for Filing Form 1040-ES in 2024

Imagine you're a novelist who's just signed a major book deal. The advance is substantial, and taxes are not withheld from this income. To avoid underpayment penalties, you could calculate your estimated tax and submit payments using the 2024 1040-ES form printable. Alternatively, suppose you've had a banner year trading stocks. Capital gain taxes aren't withheld at the time of sale, so using Form 1040-ES to cover your estimated dues would be prudent to avoid surprises come April.

Furthermore, let's say you've moved abroad for a new job. Your foreign income might also necessitate paying estimated taxes back in the States. In situations like this, the IRS Form 1040-ES in 2024 becomes a vital document to ensure compliance with your tax obligations while living overseas.

A Guide to Correcting Mistakes on Form 1040-ES

Errors can and do happen when filling out tax forms. If you've made a mistake on your 1040-ES form in 2024, here are the steps you should follow:

- Identify the Error

As soon as you realize there's a mistake on your form, review it thoroughly to understand exactly what went wrong. - Correct Future Payments

If the error pertains to calculations for future payments, adjust them accordingly on your remaining estimated tax payments for the year. - Amend Prior Payments

If your error was on a payment you've already made, you may need to correct this with an amended tax return using Form 1040-X. This is especially important if the mistake affects your annual income or tax liability. - Consult with a Tax Professional

It can be beneficial to seek guidance from a tax advisor who can help navigate the situation and advise on the best course of action.

2024 Form 1040-ES & Frequently Asked Questions

Our readers often encounter common inquiries about handling the 2024 Form 1040-ES. Here's a quick FAQ to address these questions:

- How do I know if I need to file Form 1040-ES?

You should consider filing if you expect to owe $1,000 or more in taxes after subtracting your withholdings and credits, and you expect your withholding and credits to be less than the smaller of 90% of the taxes to be shown on your current year's tax return or 100% of the tax shown on your prior year's return. - Can I file Form 1040-ES electronically?

Yes, you can use the IRS e-file system to submit your estimated tax payments. This method is both secure and convenient. - What if I miss an estimated tax payment deadline?

If you miss a deadline, make the payment as soon as possible to minimize any potential penalties. The IRS may charge a penalty for late or underpaid estimated tax payments.

Remember that for all your tax form needs, including obtaining a copy of the 1040-ES form, our website is a reliable source you can count on.

Related Forms

-

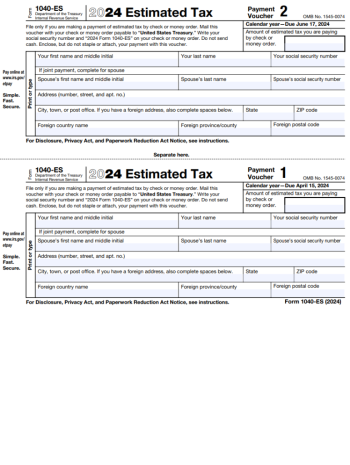

![image]() 1040-ES IRS Form 1040-ES is an important document for taxpayers who must pay estimated taxes on income not subject to withholding, such as earnings from self-employment, interest, dividends, alimony, or rental income. Estimated tax-related payments are made quarterly, and the federal 1040-ES tax form provides the necessary vouchers and guidelines to help individuals calculate and submit their payments correctly to the IRS for the 2023 fiscal year. Fill Now

1040-ES IRS Form 1040-ES is an important document for taxpayers who must pay estimated taxes on income not subject to withholding, such as earnings from self-employment, interest, dividends, alimony, or rental income. Estimated tax-related payments are made quarterly, and the federal 1040-ES tax form provides the necessary vouchers and guidelines to help individuals calculate and submit their payments correctly to the IRS for the 2023 fiscal year. Fill Now -

![image]() IRS 1040-ES Form Instructions Managing your taxes involves understanding various forms and regulations, which can sometimes be overwhelming. One essential document that certain taxpayers need to be familiar with is IRS Form 1040-ES. Whether you're self-employed, an investor, or someone with income that doesn't have taxes routinely withheld, this form likely plays a critical role in your tax preparation process. Let's decipher why this form is important and when to use it, highlight its key components, and address common pitfalls to avoid while filling it out. Purpose and Use of IRS Form 1040-ES in 2024 The primary purpose of IRS Form 1040-ES instructions for 2023 is to assist taxpayers in calculating and paying their estimated taxes quarterly. This form becomes particularly relevant if you have income that isn't subject to regular withholding - think earnings from self-employment, interest, dividends, alimony, or rental income. If you anticipate owing $1,000 or more when your return is filed, the IRS generally requires you to make estimated tax payments. It's also a crucial tool for individuals who expect to owe taxes on additional income not covered by withholding, like wages from a W-2 job. By accurately completing the 2023 IRS Form 1040-ES with instructions, you can avoid underpayment penalties and manage your cash flow more effectively throughout the year. Key Elements to Consider in Form 1040-ES Income EstimateYou'll need a reasonable estimate of your income for the year to calculate estimated payments accurately. Deductions and CreditsBe aware of deductions and credits that may reduce your tax liability, affecting the amount due each quarter. Previous Year's TaxOften, payments are based on either the tax owed from the previous year or 90% of the current year's expected tax, whichever is smaller. Due DatesEstimated tax payments are typically due on April 15, June 15, September 15 of the current year, and January 15 of the following year. Payment MethodsSeveral payment methods are accepted, including online, phone, or mail options; these can be detailed in the instructions for Form 1040-ES for 2023. Instructions to Complete IRS 1040-ES Tax Form Accurately Even with the IRS instructions for Form 1040-ES at their disposal, taxpayers often encounter stumbling blocks. Here are some typical errors and how you can avoid them: Incorrect CalculationUse the worksheets provided in the IRS instructions, and consider using tax software or consulting a tax professional to prevent calculation errors. Ignoring Changes in IncomeUpdate your estimated tax calculations as your income changes throughout the year to prevent overpaying or underpaying. Missing DeadlinesMark your calendar with the payment due dates to avoid late payment penalties and interest. Forgetting to Account for All Income SourcesInclude all taxable income when estimating your payments, from dividends and interest to any freelance income. Not Keeping RecordsMaintain copies of all your estimated tax payments to reconcile them with your annual tax return and for your records. Meticulous attention to the IRS 1040-ES form instructions will not only ensure compliance but will also aid in managing your tax obligations in a financially efficient way. As tax laws and situations can change, staying informed of updates to IRS forms and guidelines is also paramount for a smooth tax season. Fill Now

IRS 1040-ES Form Instructions Managing your taxes involves understanding various forms and regulations, which can sometimes be overwhelming. One essential document that certain taxpayers need to be familiar with is IRS Form 1040-ES. Whether you're self-employed, an investor, or someone with income that doesn't have taxes routinely withheld, this form likely plays a critical role in your tax preparation process. Let's decipher why this form is important and when to use it, highlight its key components, and address common pitfalls to avoid while filling it out. Purpose and Use of IRS Form 1040-ES in 2024 The primary purpose of IRS Form 1040-ES instructions for 2023 is to assist taxpayers in calculating and paying their estimated taxes quarterly. This form becomes particularly relevant if you have income that isn't subject to regular withholding - think earnings from self-employment, interest, dividends, alimony, or rental income. If you anticipate owing $1,000 or more when your return is filed, the IRS generally requires you to make estimated tax payments. It's also a crucial tool for individuals who expect to owe taxes on additional income not covered by withholding, like wages from a W-2 job. By accurately completing the 2023 IRS Form 1040-ES with instructions, you can avoid underpayment penalties and manage your cash flow more effectively throughout the year. Key Elements to Consider in Form 1040-ES Income EstimateYou'll need a reasonable estimate of your income for the year to calculate estimated payments accurately. Deductions and CreditsBe aware of deductions and credits that may reduce your tax liability, affecting the amount due each quarter. Previous Year's TaxOften, payments are based on either the tax owed from the previous year or 90% of the current year's expected tax, whichever is smaller. Due DatesEstimated tax payments are typically due on April 15, June 15, September 15 of the current year, and January 15 of the following year. Payment MethodsSeveral payment methods are accepted, including online, phone, or mail options; these can be detailed in the instructions for Form 1040-ES for 2023. Instructions to Complete IRS 1040-ES Tax Form Accurately Even with the IRS instructions for Form 1040-ES at their disposal, taxpayers often encounter stumbling blocks. Here are some typical errors and how you can avoid them: Incorrect CalculationUse the worksheets provided in the IRS instructions, and consider using tax software or consulting a tax professional to prevent calculation errors. Ignoring Changes in IncomeUpdate your estimated tax calculations as your income changes throughout the year to prevent overpaying or underpaying. Missing DeadlinesMark your calendar with the payment due dates to avoid late payment penalties and interest. Forgetting to Account for All Income SourcesInclude all taxable income when estimating your payments, from dividends and interest to any freelance income. Not Keeping RecordsMaintain copies of all your estimated tax payments to reconcile them with your annual tax return and for your records. Meticulous attention to the IRS 1040-ES form instructions will not only ensure compliance but will also aid in managing your tax obligations in a financially efficient way. As tax laws and situations can change, staying informed of updates to IRS forms and guidelines is also paramount for a smooth tax season. Fill Now -

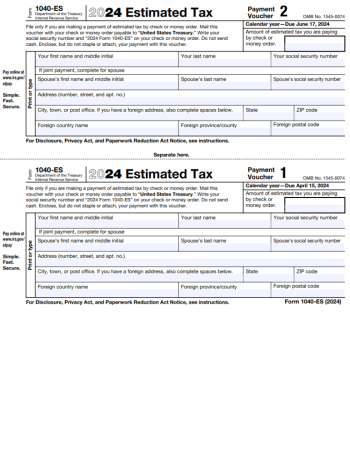

![image]() 1040-ES Printable Tax Form Form 1040-ES, known as the "Estimated Tax for Individuals," is a document used by taxpayers in the United States to pay estimated taxes on income that is not subject to withholding tax. This includes earnings such as self-employment income, interest, dividends, alimony, and rental income. The form is divided into several sections, each designed to guide taxpayers through the process of calculating and paying their estimated taxes. The main sections of the 1040-ES printable tax form include a section for identifying information, such as your name and Social Security Number; an estimated tax worksheet, which helps you to determine the amount of taxes you may owe for the year; and payment vouchers for submitting your estimated tax payments quarterly. It is crucial to use the correct year's form to ensure that you are using the most up-to-date tax rates and rules. Guidelines for Form 1040-ES Filling Out Verify the template pertains to the correct tax year. In our case, the 2023 1040-ES form printable is what you need. Provide accurate personal identification details, including your full name, address, and SSN. Use the worksheet included to calculate your estimated tax accurately, referring to your previous year's federal tax return. Determine your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year 2023. Remember to consider any changes in your financial situation that may affect your taxes for the current year. Divide your estimated tax liability by four to derive each quarterly payment amount. Steps for Submitting Form 1040-ES to the IRS Once you have completed filling out your Form 1040-ES printable for 2023, you must follow through with submitting your estimated tax payments. Here's how you can do so methodically: Gather the filled-out Form 1040-ES and the corresponding payment voucher. Write a check or money order payable to "United States Treasury" and include your Social Security Number and "2023 Form 1040-ES" on the memo line. Mail the voucher along with your payment to the appropriate address listed in the Form 1040-ES instructions, which may vary depending on your state of residence and the method of payment. If you prefer to pay electronically, you can use the IRS Direct Pay system or the Electronic Federal Tax Payment System (EFTPS). Ensure each quarterly payment is postmarked by the due date to avoid any potential penalties or interest for late payments. Deadline for Printable 1040-ES Form Submission Estimated tax payments are divided into four payment periods, and each payment has a different due date. For the tax year 2023, the form and payments are typically due on April 15, June 15, September 15, and January 15 of 2024. If these dates fall on a weekend or holiday, the deadline is moved to the next business day. Lastly, for those looking to get started right away, a 2023 printable 1040-ES tax form is readily available for download on our website at no cost. Additionally, if you simply need a blank 1040-ES for print, that too can be procured from our site, allowing you to have a fresh copy whenever needed. Fill Now

1040-ES Printable Tax Form Form 1040-ES, known as the "Estimated Tax for Individuals," is a document used by taxpayers in the United States to pay estimated taxes on income that is not subject to withholding tax. This includes earnings such as self-employment income, interest, dividends, alimony, and rental income. The form is divided into several sections, each designed to guide taxpayers through the process of calculating and paying their estimated taxes. The main sections of the 1040-ES printable tax form include a section for identifying information, such as your name and Social Security Number; an estimated tax worksheet, which helps you to determine the amount of taxes you may owe for the year; and payment vouchers for submitting your estimated tax payments quarterly. It is crucial to use the correct year's form to ensure that you are using the most up-to-date tax rates and rules. Guidelines for Form 1040-ES Filling Out Verify the template pertains to the correct tax year. In our case, the 2023 1040-ES form printable is what you need. Provide accurate personal identification details, including your full name, address, and SSN. Use the worksheet included to calculate your estimated tax accurately, referring to your previous year's federal tax return. Determine your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year 2023. Remember to consider any changes in your financial situation that may affect your taxes for the current year. Divide your estimated tax liability by four to derive each quarterly payment amount. Steps for Submitting Form 1040-ES to the IRS Once you have completed filling out your Form 1040-ES printable for 2023, you must follow through with submitting your estimated tax payments. Here's how you can do so methodically: Gather the filled-out Form 1040-ES and the corresponding payment voucher. Write a check or money order payable to "United States Treasury" and include your Social Security Number and "2023 Form 1040-ES" on the memo line. Mail the voucher along with your payment to the appropriate address listed in the Form 1040-ES instructions, which may vary depending on your state of residence and the method of payment. If you prefer to pay electronically, you can use the IRS Direct Pay system or the Electronic Federal Tax Payment System (EFTPS). Ensure each quarterly payment is postmarked by the due date to avoid any potential penalties or interest for late payments. Deadline for Printable 1040-ES Form Submission Estimated tax payments are divided into four payment periods, and each payment has a different due date. For the tax year 2023, the form and payments are typically due on April 15, June 15, September 15, and January 15 of 2024. If these dates fall on a weekend or holiday, the deadline is moved to the next business day. Lastly, for those looking to get started right away, a 2023 printable 1040-ES tax form is readily available for download on our website at no cost. Additionally, if you simply need a blank 1040-ES for print, that too can be procured from our site, allowing you to have a fresh copy whenever needed. Fill Now -

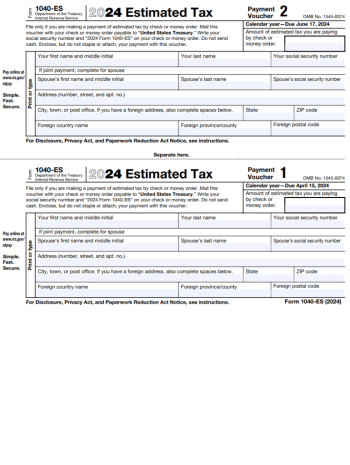

![image]() Federal 1040-ES Tax Form Form 1040-ES is a crucial tax document used by the IRS to manage estimated tax payments. Estimated tax is the method used to pay taxes on income that isn't subject to withholding. This generally includes income from self-employment, interest, dividends, alimony, rent, gains from the sale of assets, prizes, and awards. It is essential for some individuals to make quarterly estimated tax payments to cover these earnings and avoid possible penalties for underpayment. Recent Changes to Federal Form 1040-ES Each tax year can bring updates to tax forms that taxpayers need to be aware of. For the 2023 federal 1040-ES form, some changes reflect adjustments due to inflation and revised tax laws. For instance, income thresholds for estimated taxes are indexed for inflation, which might alter the amount one needs to pay. Always check the latest version of any tax form, including 1040-ES, for these updates before making your payments. Terms to Use the Federal 1040-ES Form Generally, you may need to file a federal income tax form 1040-ES if you expect to owe at least $1,000 in taxes after subtracting your withholding and credits and you expect your withholding and refundable credits to be less than the smaller of 90% of the tax to be shown on your current year tax return, or 100% of the tax shown on your prior year's tax return. Those who are salaried and have taxes withheld from each paycheck typically do not need to worry about this form. However, not everyone is required to file this form. If you meet certain conditions, such as having had no tax liability in the prior year, being a U.S. citizen or resident for the whole year, and your prior tax year covered a 12-month period, you may not be required to make estimated tax payments. The 1040-ES Online Submission To reap the full benefits of making estimated tax payments with the federal 1040-ES form for 2023, it is important to calculate these payments as accurately as possible. Overpaying can lead to a large tax refund, which means you've essentially given the government an interest-free loan. Underpaying can result in penalties and interest charges. One way to achieve accuracy is by basing your estimates on eventual actual income and deductions throughout the year if your income fluctuates. For convenience and accuracy when making payments, consider submitting your estimated taxes online. The IRS offers various electronic payment options, such as using the Electronic Federal Tax Payment System (EFTPS) or IRS Direct Pay which can be associated with filing or directly paying through your federal 1040-ES online. This digital approach can help with the following issues: ensuring timely payments, confirmation of submission, reducing the risk of mail-related delays or errors. As a final recommendation, always keep records of your estimated tax payments. It's important for reconciling your payments on your annual return and valuable for correcting any discrepancies with IRS records. Always refer to a reliable source, such as our website, to obtain the most current blank 1040-ES federal form and instructions on how to fill it out. Staying informed and prepared is key to successful tax planning and compliance. Fill Now

Federal 1040-ES Tax Form Form 1040-ES is a crucial tax document used by the IRS to manage estimated tax payments. Estimated tax is the method used to pay taxes on income that isn't subject to withholding. This generally includes income from self-employment, interest, dividends, alimony, rent, gains from the sale of assets, prizes, and awards. It is essential for some individuals to make quarterly estimated tax payments to cover these earnings and avoid possible penalties for underpayment. Recent Changes to Federal Form 1040-ES Each tax year can bring updates to tax forms that taxpayers need to be aware of. For the 2023 federal 1040-ES form, some changes reflect adjustments due to inflation and revised tax laws. For instance, income thresholds for estimated taxes are indexed for inflation, which might alter the amount one needs to pay. Always check the latest version of any tax form, including 1040-ES, for these updates before making your payments. Terms to Use the Federal 1040-ES Form Generally, you may need to file a federal income tax form 1040-ES if you expect to owe at least $1,000 in taxes after subtracting your withholding and credits and you expect your withholding and refundable credits to be less than the smaller of 90% of the tax to be shown on your current year tax return, or 100% of the tax shown on your prior year's tax return. Those who are salaried and have taxes withheld from each paycheck typically do not need to worry about this form. However, not everyone is required to file this form. If you meet certain conditions, such as having had no tax liability in the prior year, being a U.S. citizen or resident for the whole year, and your prior tax year covered a 12-month period, you may not be required to make estimated tax payments. The 1040-ES Online Submission To reap the full benefits of making estimated tax payments with the federal 1040-ES form for 2023, it is important to calculate these payments as accurately as possible. Overpaying can lead to a large tax refund, which means you've essentially given the government an interest-free loan. Underpaying can result in penalties and interest charges. One way to achieve accuracy is by basing your estimates on eventual actual income and deductions throughout the year if your income fluctuates. For convenience and accuracy when making payments, consider submitting your estimated taxes online. The IRS offers various electronic payment options, such as using the Electronic Federal Tax Payment System (EFTPS) or IRS Direct Pay which can be associated with filing or directly paying through your federal 1040-ES online. This digital approach can help with the following issues: ensuring timely payments, confirmation of submission, reducing the risk of mail-related delays or errors. As a final recommendation, always keep records of your estimated tax payments. It's important for reconciling your payments on your annual return and valuable for correcting any discrepancies with IRS records. Always refer to a reliable source, such as our website, to obtain the most current blank 1040-ES federal form and instructions on how to fill it out. Staying informed and prepared is key to successful tax planning and compliance. Fill Now